A Historic Fraud: The Run that Exposed the Giant

This is the second post in a four-part series explaining the fall of FTX and the ultimate indictment against its founder, Sam Bankman-Fried (SBF). In the first post, we reviewed SBF’s background, the creation of FTX, and how FTX generated revenue for its owners. In this second part, we will build off that revenue structure to explain the market dynamics which forced FTX to file for bankruptcy in late 2022. These first two posts will lay the necessary groundwork to understand the government’s indictment against SBF.

FTX’s Assets and Revenue Model

As discussed in the prior post, FTX created revenue through various channels; including, holding FTT tokens, staking FTT tokens, charging exchange fees, investing customer assets, and selling FTT tokens through initial exchange offerings. Each of these streams was vital to FTX’s viability as a leading exchange in the crypto space.

In mid-2022, FTX appeared strong financially. Their FTT token holdings alone were worth over $2 billion dollars. FTX was one of the leading exchanges based on volume. This volume led to substantial income through exchange/trading fees. FTX was generating returns by staking their own tokens. They had access to customer funds through deposits on the exchange. From 30,000 feet, FTX appeared to be cruising along as a well-executed plan by crypto’s biggest player.

That image changed rapidly in November of 2022. A financial statement was released outlining assets and liabilities for SBF’s trading corporation, Alameda Research Group. The statement showed FTX loaned Alameda millions of FTT tokens. It showed Alameda was losing substantial money through trading activities in 2022. Further, the financials laid out billions of dollars in liabilities largely built from loans to the company.

Two important conclusions rose from the financial statements: 1) FTX was transferring customer FTT tokens to Alameda for investments and 2) the two sister companies had tied their value almost exclusively to the FTT token.

Transferring FTT to Alameda

A pivotal take away from the financials was the recognition FTX was loaning customer funds to Alameda for investment purposes. FTX gained access to customer funds through two processes; deposited funds and the FTX staking protocol. Since each avenue is unique, we will tackle them separately.

FTT Staking Protocol

FTX’s staking protocol allowed investors to give FTX custody of an approved crypto token in exchange for a return on the investment. The operation was akin to certified deposits or any bank loan in the United States. Token holders could give something of value to the exchange and the exchange would agree to pay the value back plus interest at the conclusion of the custody.

This deal works well for token holders as they have a clearly delineated percentage return for locking their tokens for a period of months. FTX could stake the tokens to secure the source chains, and obtain a fee for that service, or use the locked tokens for personal ventures before returning them to the original user.

The above process is the common avenue for staking assets on exchanges. However, FTX used a slightly different set up for their native FTT token. Under the FTT staking protocol, FTT holders could give custody of their tokens to FTX in exchange for other benefits. Instead of receiving interest on the deposit, FTT stakers would get other perks such as lower trading fees, airdrops for Solana based tokens, and higher limits on deposits and withdrawals. This incentive structure is different from the common avenue outlined above, but for our purposes, the result is the same – FTX staking protocols allowed them to access customer funds.

Diverting Funds in a Custodial Exchange

In the crypto space, there are two relevant types of exchanges, custodial and non-custodial. The main distinction lies in the control of the on-exchange assets. In a custodial exchange, the exchange itself controls the assets deposited on the platform. In a non-custodial exchange, the user never relinquishes control over their cryptocurrency.

Most of the major exchanges are custodial, including Coinbase, Kraken, and Gemini. This means the exchange itself controls all of the cryptocurrency deposited on the platform. All trades or adjustments in holdings are documented via the company’s balance sheets. The blockchain itself plays no role in the day-to-day activities of the exchange. In this way, a custodial exchange operates like a classic bank. A person deposits money into the bank. The bank is responsible for securing the funds. The person expects to have access to the funds when called upon.

This general structure explains how FTX interacted with user assets. If a user wanted to trade on FTX (custodial), they transferred their funds onto the exchange. Once complete, the funds were held by the exchange itself and noted on the exchange asset profile for that user. The funds were no longer tied to the blockchain. A user was free to trade their funds within the exchange for other assets. Once trades were complete, the user could initiate a withdraw of the assets to their own personal wallet. At that stage, custody had been returned to the user.

This process is simple conceptually. However, it requires the exchange to hold sufficient funds to meet the withdraw demand. If an exchange uses customer funds for their own benefit, they must maintain balances sufficient to cover any demands from other users. A custodial exchange that diverts customer funds is playing a dangerous game. A run on the exchange will surely expose any solvency issues that resulted from mismanaging assets.

Though FTX claimed to merely hold custody of client funds, their general procedure included diverting exchange funds for their own investments. The SEC complaints show FTX was removing significant funds from the exchanges in order to entertain risky ventures through Alameda. This diversion of funds is the lynch pin to FTX’s collapse.

Failure to Diversify Assets

In addition to the diversion of FTT tokens, the report provided insight into the asset profiles for Alameda and FTX. Under the financial report, Alameda’s assets were worth over $14 billion in mid-2022. However, ~42% of that worth, or $6 billion, was tied directly to FTT holdings. Another $3.3 billion consisted of unnamed cryptocurrency holdings. Over 60% of Alameda’s worth was related to current crypto holdings.

This asset profile was listed alongside their liabilities sheet. Alameda showed substantial liabilities under various loans. The total liabilities were approximately $8 billion. The Alameda financial statement painted the picture of an unhealthy hedge fund that used FTX as its personal piggy bank.

Binance Jumps Ship and Retail Investors Follow

Binance Labs is a major player in the crypto space. Their exchange, Binance, is the largest crypto exchange by volume in the world. The company often uses its capital to invest in newer crypto start ups.

In 2019, Binance Labs was one of the first investors in the FTX project. The company received millions of FTT tokens in exchange for their capital contribution. In 2022, word began to spread that FTX was potentially insolvent; ie, they did not have the capital to cover the funds deposited on their exchange. In response, Binance CEO, Changpeng Zhao (CZ), went public with his plans to immediately liquidate their FTT holdings. Their holdings were worth over $500 million at the time of the statement.

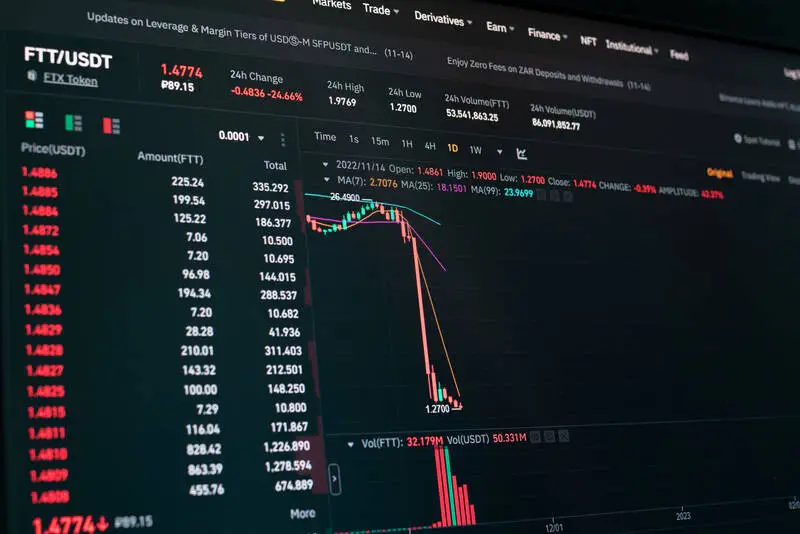

CZ’s announcement started a run on the FTX exchange to withdraw assets. Users in the staking protocol initiated transactions to unstake and remove their assets. Users with assets on the FTX exchange moved to withdraw their funds. FTT holders and FTX exchange users were distancing themselves from FTX at a dizzying pace. SBF struggled to stay afloat amidst the barrage of withdraw requests.

Within 24 hours, over $6 billion in crypto assets had been withdrawn from FTX. Two days later, FTX admitted defeat. SBF shut down withdraws from the exchange in recognition of their inability to make the payments. The exchange had gone belly up in a matter of hours.

The failure of the exchange was exacerbated by the total collapse of the FTT token price due to significant selling pressure. On November 1, 2022, the FTT token was worth $25.87. One week later, FTT was worth $2.28. This represented a 91% drop in the token price in seven days. Considering FTX’s and Alameda’s huge FTT holdings, this drop sealed FTX’s fate.

FTX and Alameda filed for bankruptcy and turned the company over to new management. The bankruptcy court continues to work through the financials in an attempt to pay creditors and FTT holders. That process could take years to complete.

Moving Towards SBF’s Indictment

The bankruptcy proceedings opened the true financial situation of both FTX and Alameda. For the first time, SBF was not the gatekeeper of records and transactions. The company transferred power to a new CEO, John Ray III, to guide them through the Chapter 11 bankruptcy process. Ray is infamous for performing a similar feat for Enron following their historic accounting scandal in 2001. Ray’s first job was to collect information and begin working with the bankruptcy courts to make investors whole.

The bankruptcy process was dangerous for SBF as any misdeeds or improper diversions would become public knowledge. As is often the case, the evidence collected in the bankruptcy proceedings began to trickle down to federal authorities. In response, the federal government began their review of SBF’s management of customer funds. That review resulted in a multi-count indictment against SBF, FTX co-founder, Gary Wang, and an Alameda Executive, Caroline Ellison. The indictment accused the parties of wire fraud, commodities fraud, securities fraud, money laundering, and campaign finance fraud.

In the next post, we will dive into the criminal allegations against all three parties. We will dissect the law behind each count, reconstruct the factual narratives that support each allegation, and outline some defenses that may be available to SBF.

For more information, visit the page devoted to our criminal crypto tax attorneys.